haulage - truck finance

Truck finance

✅ Fast and secure finance to grow your fleet of trucks

✅ Compare your options from our panel of lenders

✅ Check your eligibility free, without affecting your business credit score

We're ready to help.

✅ Fast and secure finance to grow your fleet of trucks

✅ Compare your options from our panel of lenders

✅ Check your eligibility free, without affecting your business credit score

Truck finance is a type of asset finance, specially designed for the purchase of trucks, HGVs, or lorries. It's a form of lending that allows your business to purchase a truck without the hefty upfront costs. Businesses that don't have a long trading history or a good credit score can still access truck finance in many cases. This is because the loan is secured against the truck, lowering the risk to the lender.

Here’s a step-by-step look at how truck finance typically works:

1. Choose a truck for your business

First things first, figure out what kind of truck you need for your business. Consider factors like the size of the truck, its purpose (delivery, transportation, etc.), and your budget.

2. Decide how you’d like to use your truck

There are different types of truck finance available, each catering to various needs. Make sure to think about what’s important for your business to see which would work for you. If you prefer to own the truck outright eventually, hire purchase might be suitable. If you want more flexibility and lower upfront costs, leasing could be the way to go. Don't worry if you don't have a definitive answer right now. Our funding specialists will help you decide which kind of truck finance and lender is most suitable.

3. Apply for finance

Now it's time to apply. Simply start a funding search with Capitalise and you’ll be able to apply to four lenders in one application. You'll need to provide information about your business and details about the truck you want to finance. Be prepared to submit documents like bank statements as part of the application.

4. Get a decision

Once you've applied, the finance provider will review your application and decide whether to approve it. They'll assess the creditworthiness of your business and the value of the truck you're financing. If approved, they'll provide you with an offer that details specific terms like interest rates, repayment schedules, and any upfront costs.

5. Purchase the truck

With finance approved, you’ll receive the funds so that you can proceed to purchase the truck. If you're leasing the truck, the lender may handle the purchase for you.

6. Make regular payments

Once you have the truck, you'll need to make regular payments according to the terms of your finance agreement.

7. Own or return the truck

If you choose a finance option that leads to ownership, such as hire purchase, you'll eventually pay off the finance, and the truck will belong to your business. If you leased the truck, you'll typically have the option to return it at the end of the lease term, or negotiate a buyout to own it.

There are different types of truck finance available, the most common types are:

Typically, you’ll hire the truck from the lender and make repayments over a set period. Once the repayments are complete, your business owns the vehicle.

A flexible choice for businesses that need trucks for a short time or want to skip the responsibilities of owning them. You pay a fixed monthly rental fee to use the truck for an agreed time, usually shorter than its full lifespan. When the time's up, you simply give the truck back to the lender with no extra commitments.

You pay a set amount each month to use the truck for an agreed period of time. When the lease is up, you usually have three options: give the truck back, keep leasing it, or buy it for its remaining value.

When applying for truck finance, the lender will consider the age of the truck and its value to determine how much you’ll need to borrow.

It’s important to show the lender that your business is financially healthy and will be able to repay the loan.

To maximise your chances of being approved, make sure that your business has:

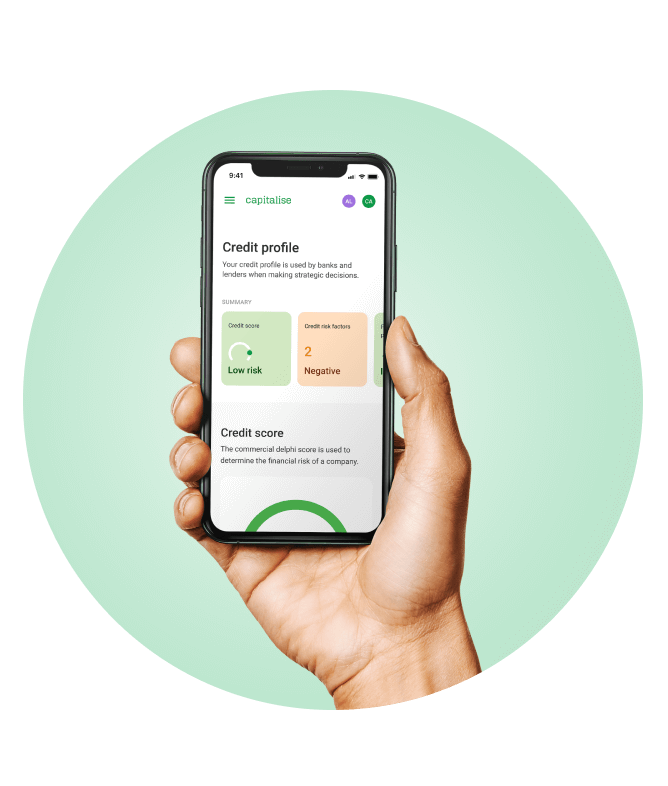

✅ Know your business credit score

✅ Understand the factors impacting it

✅ Alerts on risks to your profile

✅ All features from as low as £19/month

You can use our business loan calculator to help you estimate the costs involved in financing a truck through your business. The calculator will consider factors such as the truck’s full price, your deposit, the term length,and interest rates to calculate your estimated monthly repayments.

Truck finance allows your business to spread the cost of a truck over time, freeing up cash flow for other expenses.

Your truck may be eligible for Capital Allowances, meaning you can deduct the full cost of the truck in the first year. You may also be able to claim your monthly repayments as expenses which can be deducted from your Corporation Tax.

Truck finance allows you to access newer and more reliable trucks than you may be able to afford outright.

Commercial truck finance terms typically range from 12 to 60 months, with options for short-term (12 to 36 months), medium-term (36 to 60 months), and occasionally longer terms for newer or expensive trucks. Lease terms can also vary, spanning from 12 to 60 months. How long you choose to finance a truck for will depend on factors such as your budget, cash flow, and the desire to pay off the truck quickly, versus spreading smaller payments out over a longer period.

When choosing a truck to finance, it's important to consider your business' needs. Some factors to consider include:

We can help by connecting you with a wide range of specialist lenders. Speak to one of our funding specialists to find the right option to fund your truck purchase.

There are a number of specialist lenders that can help you finance a truck for your business.

To help you find the best deal, at Capitalise, we work with 100+ UK lenders. This means that you can find, compare and apply for truck finance with multiple lenders, all in one application. Just sign up for free to get started.