compare business loans

Business Loans

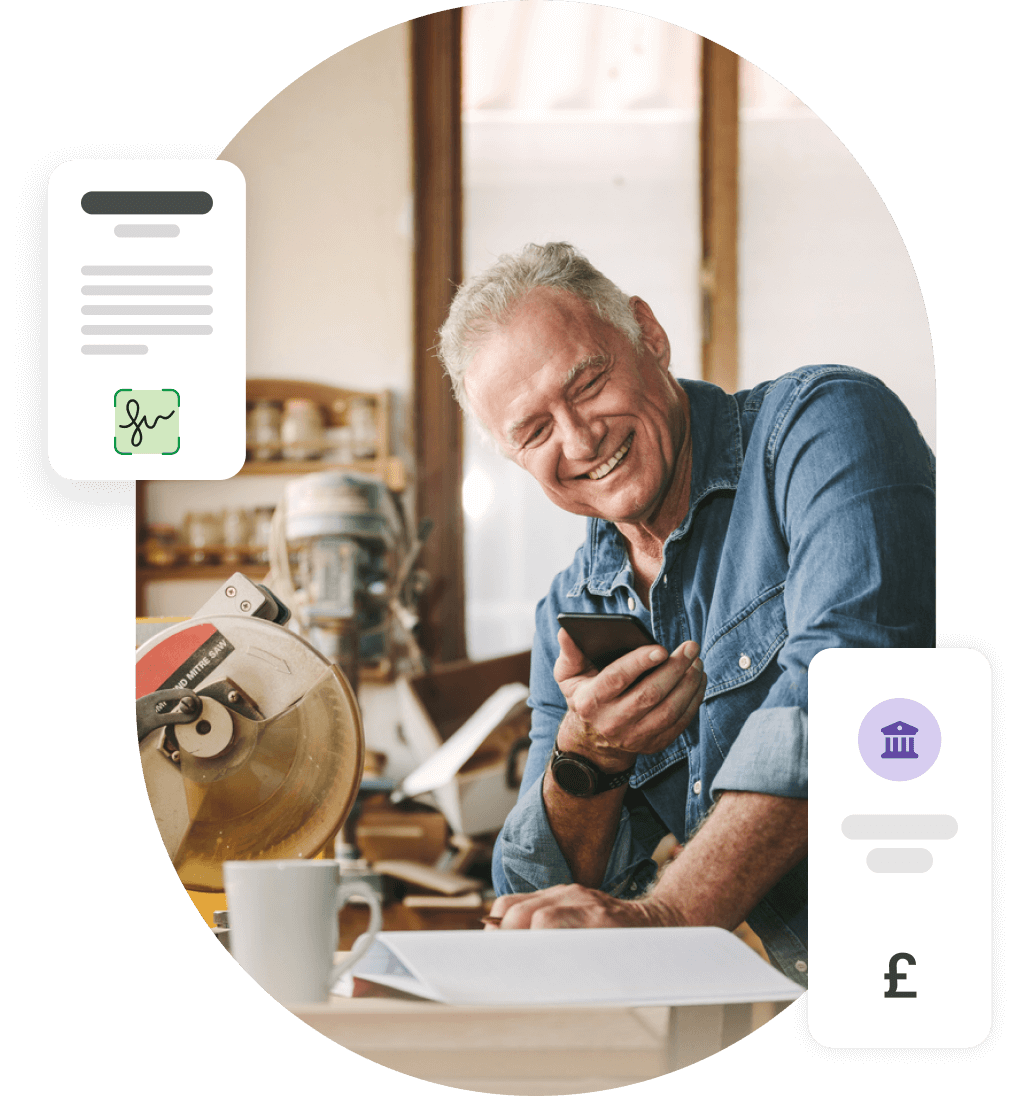

- Search from over 100 UK lenders

- Check affordability without affecting your credit score

- Business loans from £5,000 - £10m+

- Get business loans in as little as 48 hours

A business loan is a type of borrowing that meets the financial needs of a company, rather than for personal use.

It provides a business with a sum of money that can be used to fund various business activities, such as starting a new business, expanding operations, purchasing equipment or inventory, covering operating expenses, or managing cash flow.

The terms of a business loan can vary widely depending on the lender, the type of loan, and how creditworthy the business is.

To get a business loan, you’ll need to apply to a lender who will decide whether to lend your business money. If you are approved for a business loan and accept the terms, you will receive the funds. You will repay the business loan, usually on a monthly basis with a fixed repayment until the amount is repaid in full, including interest.

Your eligibility for a business loan will depend on factors such as your business’ finances as well as the lender’s individual requirements.

Generally, to be eligible for a business loan, your business will need to have:

See what business loans you're eligible for.

There are different factors that will affect the rates of a business loan and how much it will cost your business.

When you apply for a business loan, lenders will usually assess the creditworthiness of the business by looking at your business credit score, the business’ financial history, profitability and any assets owned. This evaluation helps the lender to determine the risk associated with lending to the business and will determine what rates they offer.

Some business loans will also include an initial arrangement fee, or early repayment fees.

Many lenders require evidence of turnover and trading history, so as a startup it can be difficult to get a business loan. However there are some specialist lenders that could help. Find out more about startup business loans.

Yes, to take out a business loan you’ll need to be a director of the business.

To qualify for a business loan from a UK lender, your business must be based in the UK.

The loan amount you can borrow depends on factors such as your business's financial health, revenue, creditworthiness, and the lender's policies. Use the Business Loan Calculator to see how much your business can borrow.

It is possible to get a business loan with bad business credit, however you may find it difficult to get an unsecured business loan, or a business loan from a traditional bank. There are options available for businesses with bad credit, as some lenders will look at other factors, such as your assets or debtor book. At Capitalise, we work with over 100 lenders to help you find an option for your business. Find out more about bad credit business loans.

No, Capitalise is a brokerage, not a lender. This means we can give you choice over the market and find a business loan that is the best fit for you.

To apply for a business loan, lenders will need to see the following documents:

The specific documents may vary depending on the lender and loan type.

If you miss a business loan repayment, you must contact the lender as soon as possible to resolve the issue. If you default on your business loan, this will severely affect your credit score and the lender could enforce action against you.

Capitalise gives you access to 100+ UK lenders so you can compare the best rates. With support from our team of funding specialists, you can get the best business loan rates available to your business.