FINANCE OPTIONS - TRADE FINANCE

Trade credit - what it is and how you can access more

Trade credit, also known as supplier credit, is an arrangement between two businesses in which one business (the supplier) allows the other business (the buyer or customer) to purchase goods or services on credit terms, allowing the buyer to pay at a later date.

Trade credit also involves credit terms, this refers to the specific conditions and arrangements agreed upon between a supplier (vendor) and a buyer (customer) regarding the extension of credit for the purchase of goods or services. These terms outline the conditions under which the buyer can make purchases on credit and when and how the payments should be made.

Credit terms will include a credit period, which specifies the length of time during which the buyer can use the purchased goods or services before payment is due. For example, "net 30" means the buyer has 30 days to make the payment from the date of invoice.

Credit terms will also include any conditions such as a discount to the buyer for early repayment, or late payment fees.

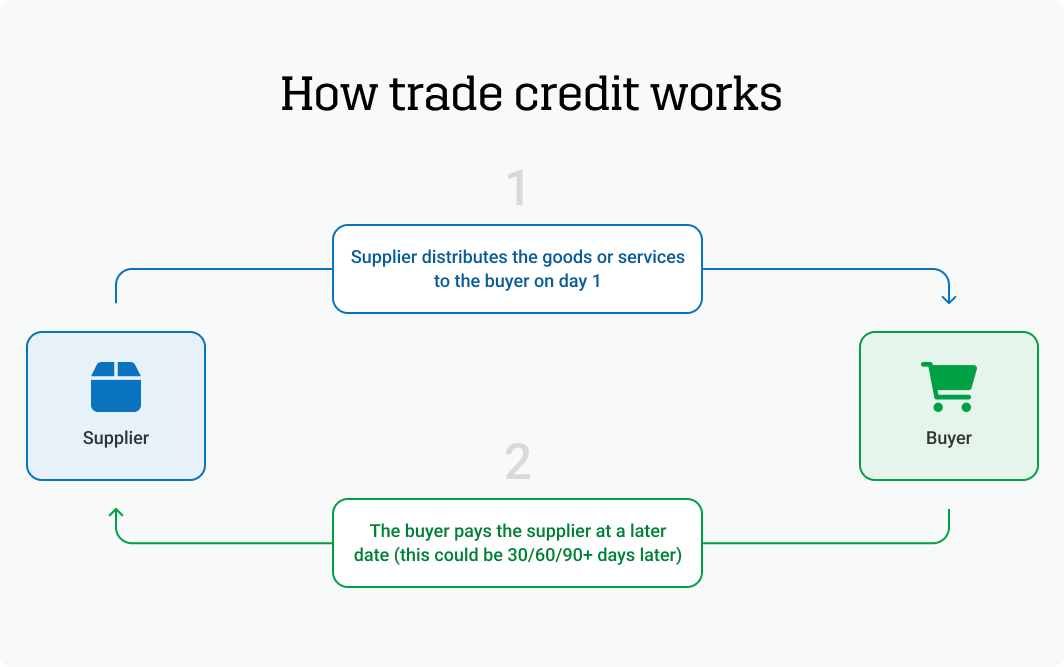

Trade credit works by a supplier releasing goods or services to the buyer. The buyer then pays for the goods at a later agreed upon date.

Here’s a breakdown of how trade credit works:

A variety of factors can impact the amount of trade credit and the terms that your business could access. For example, the industry of a business can affect the credit terms. While e-commerce or merchant businesses may have shorter trade credit terms, manufacturing businesses may be able to access longer credit terms. This is due to the typical length of the customer cycle for the business.

The amount of trade credit a business can access will also depend on the strength of their business credit score. If you have a good business credit score, this will demonstrate to the supplier that you are creditworthy and likely to repay on time, so they may be more likely to offer you trade credit and potentially extended payment terms.

Your business credit profile will also include a suggested credit limit as an amount in pounds (£). Your credit limit is the maximum amount the credit bureau recommends your supplier should extend to you. The higher your credit limit is, the more trade credit you will be able to access with each of your suppliers.

The amount of trade credit you can access largely depends on your business credit score and recommended credit limit.

Our Credit Review Service provides you with the ability to have your Experian business credit score reviewed and in 96% of cases this results in an improvement.

With an improved credit limit, this means you could access more trade credit with every single one of your suppliers.

While trade credit offers numerous advantages, it's essential to manage it responsibly to avoid financial pitfalls. Use the following tips to manage your trade credit:

Trade credit is commonly used by businesses in the construction sector. For example, a painter, decorator, or carpenter business may access trade credit from Screwfix or Travis Perkins, to access the materials they need to complete a job without the upfront costs.

However, trade credit could be beneficial for businesses in any sector. If you work in the retail sector, you could use trade credit to purchase new stock to meet high demand. Alternatively, if you operate in the manufacturing industry, trade credit could be extended to wholesalers and distributors for bulk purchases, facilitating distribution and sales.

There are a number of alternatives to trade credit, such as invoice finance, a merchant cash advance, or a traditional business loan. These options provide various ways to secure finance, manage working capital, and meet specific financial needs for a business. The choice among these alternatives depends on the business's unique circumstances, their creditworthiness, and objectives. At Capitalise, we work with 100+ lenders offering a variety of options for your business. You can speak to a funding specialist to determine what could work best for your specific needs.

Yes, there are risks associated with trade credit, such as late payment penalties, strained supplier relationships, and potential damage to a business's creditworthiness if payment obligations are not met.

If a business faces difficulty paying trade credit invoices, it is important to communicate with the supplier as early as possible to discuss payment options or request extensions. Open and transparent communication can help avoid strained relationships.

Yes, trade credit can be used for the purchase of both goods and services, depending on the agreement between the buyer and supplier.

No, trade credit and business loans are different. Trade credit is a form of credit provided by suppliers to buyers for the purchase of goods and services, while a business loan is a lump sum of money borrowed from a lender for various business needs, which will be repaid with interest.

Trade credit insurance is a tool used by businesses to safeguard against the risk of customer non-payment. With trade credit insurance, a business purchases a policy from an insurance company that covers a portion of its outstanding receivables against non-payment due to factors such as customer insolvency or default. The insurance company assesses customer creditworthiness and provides recommendations, and in the event of a covered default, the insured business can file a claim for reimbursement.