credit risk manager

Sync contacts with cloud accounting to supercharge your credit control.

See your customer invoices and debtor risks, all in one place.

See your customer invoices and debtor risks, all in one place.

If you offer credit to a customer, there is always a risk that they may not pay their invoice on time, leaving you short changed. Knowing which customers to start chasing for payment and when is a fine balance and could be the difference between making your numbers or missing them. Credit risk manager gives you the ability to prevent threats to your cash flow by managing your credit risks, all in one place.

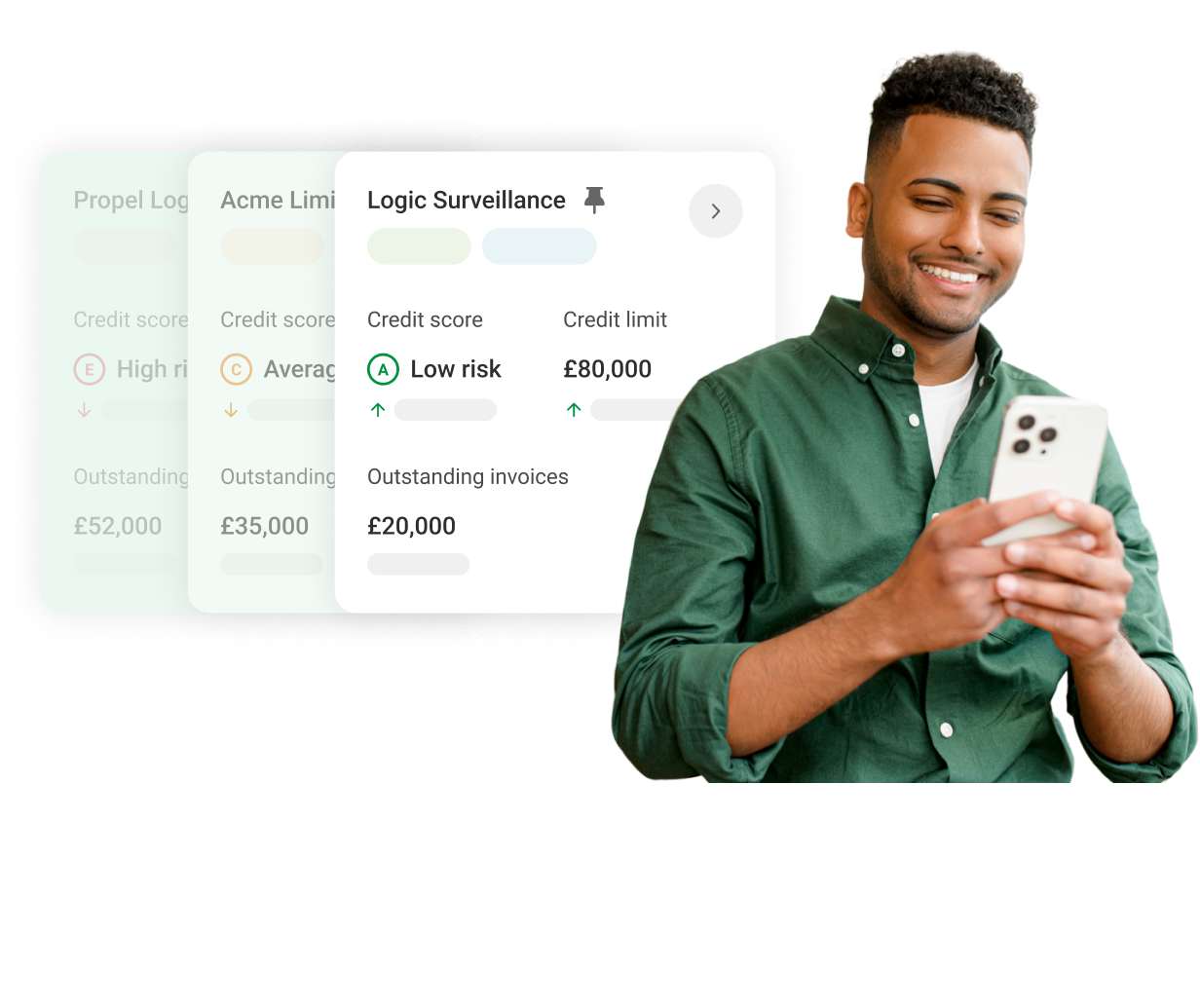

When you connect your cloud accounting software to your Capitalise profile, you’ll see your customer invoices, next to their credit risks, so you know which invoices you need to prioritise chasing to ensure you get paid.

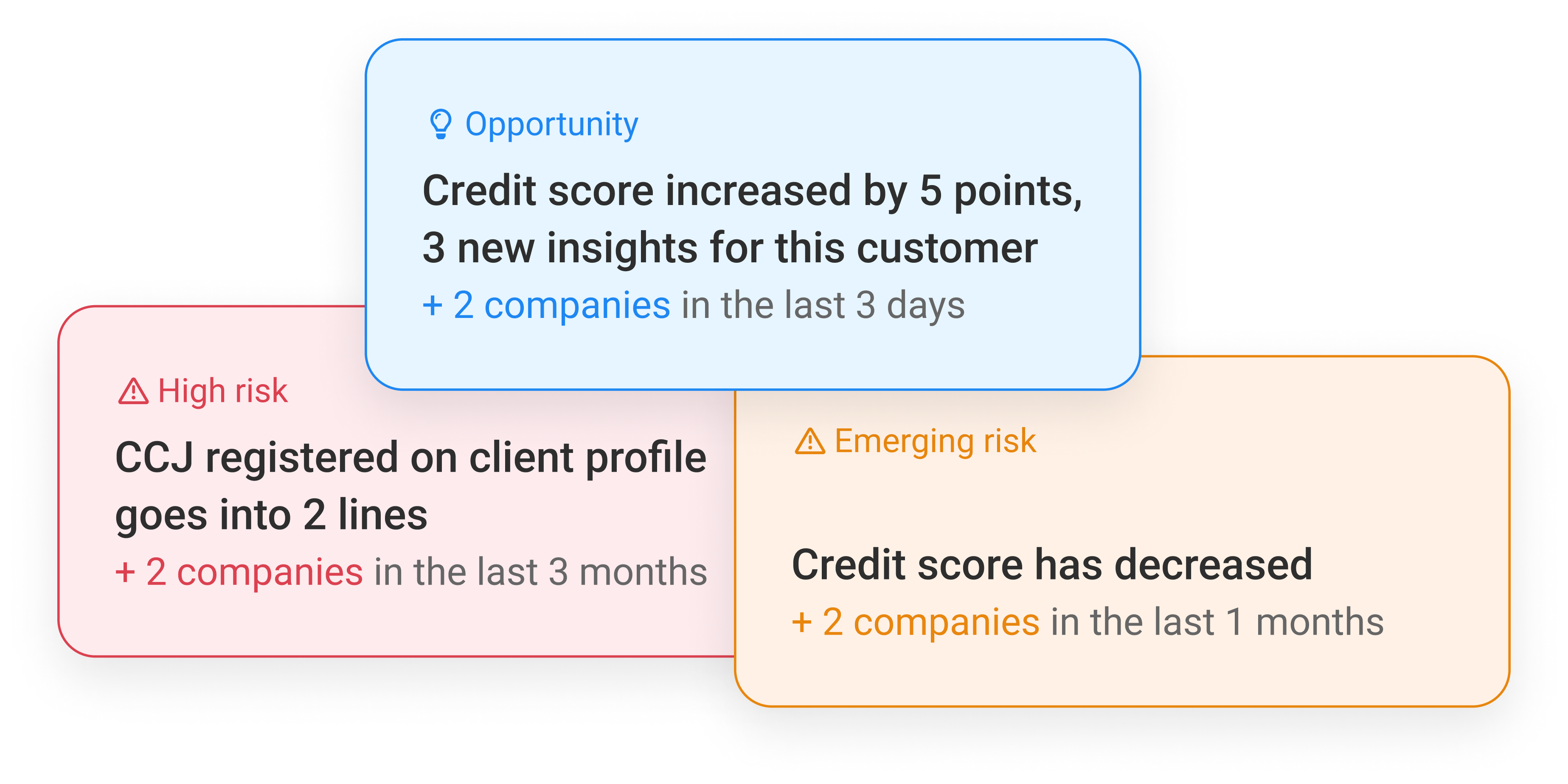

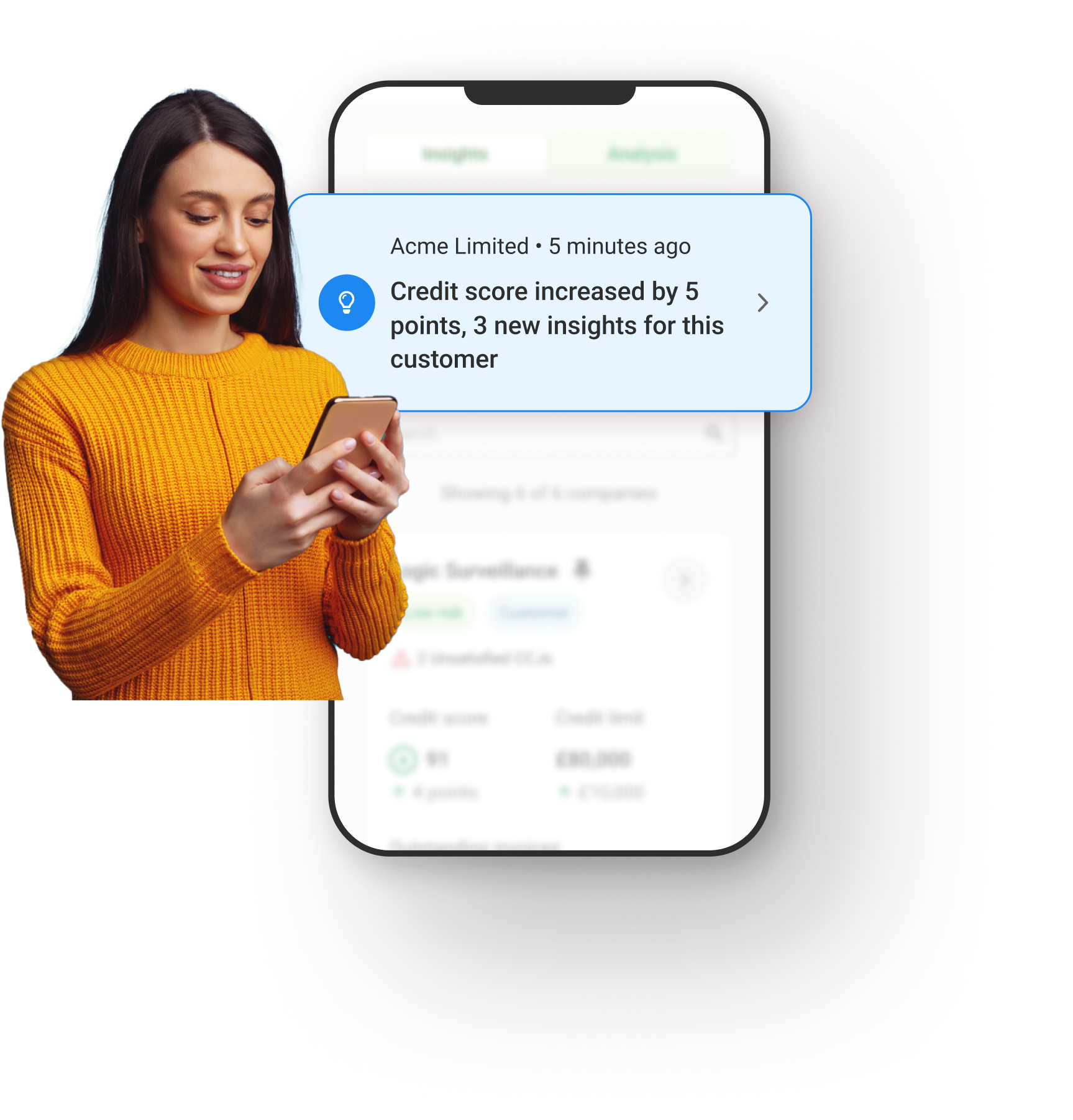

And with real time alerts, you’ll get notified instantly of any changes to a company’s credit profile, meaning you can act earlier, while maintaining your client relationships.

Nasty surprises like a late invoice can take a toll on your cash flow, and ultimately your bottom line. So wouldn’t it be helpful to know if a customer is likely to pay late, ahead of time?

Spotting early warning signs from your customers, such as a declining payment performance, or a registered CCJ, next to their invoices can help you to identify where there are threats to your cash flow. With a customer's suggested credit limit, alongside their outstanding invoice, you'll also have immediate insights into whether you're overextending credit and need to take action.

If you work with multiple companies, it's essential to know how to focus your credit control efforts. But spending time switching between platforms to manage your invoices and credit risks, means you’re not spending time on other valuable areas of your business.

Syncing your contacts from Xero, QuickBooks, or Sage allows you to manage your credit terms effectively. Viewing your credit risks, next to all of your outstanding invoices means you’ll instantly know which invoices are most at risk and which debtors to prioritise chasing.

Being aware of cash flow threats too late can leave you scrambling to find solutions. By the time you notice a large customer is a risk, it might be too late to find an amicable solution.

With real-time alerts, we’ll let you know instantly of any changes to a customer’s credit profile, so you can act quickly.

Track your business credit score, get started for free

Reduce risk to your business by running company credit checks on customers, suppliers and competitors

Get matched with the right lenders for your business with a single search.

Credit risk means the likelihood of your business not receiving money that you’re owed due to a debtor not paying. If you invoice your customers, credit risk is essentially the probability that your invoice might not be paid on time, or at all.

Credit control is the process of a business managing and regulating the credit it extends. The purpose of credit control is to ensure that the business’ customers pay their outstanding invoices on time and to minimise the risk of bad debts or non-payment. The credit control process involves credit checking existing and potential customers to see how likely they are to pay on time, as well as determining the maximum amount of credit that should be extended to them.

Credit risk management is the process of reducing the risk of non payment to your business. It involves practices like credit checking your customers to see if they are likely to pay on time and keeping track of any changes so you can proactively take action if needed.

Credit risk management will have a significant impact on your’ business’ cash flow and overall financial health. Effective credit risk management helps you identify and mitigate the risk of non-payment or default by customers, ensuring your cash flow is well protected and your business can continue to operate.

Implementing credit risk management in your business is easy with Capitalise. By connecting to Xero, QuickBooks, or Sage, Credit Risk Manager allows you to see all the credit risks from your customers, alongside their outstanding invoices. This gives you all the information you need for effective credit risk management, in one place.

You can view financial insights into your cash flow by syncing your contacts and invoices from your cloud accounting software to Credit Risk Manager. You’ll be able to identify any emerging risks to your cash flow, such as a customer with a CCJ, while also assessing the extent of exposure based on the outstanding debt owed to your business.

To reduce credit risks to your business, you should credit check your existing and potential customers before extending credit or choosing to work with them. This will give you an indication of whether you need to ask for upfront payment, or the maximum amount of how credit you should extend to them.

You can also reduce credit risks to your business by ensuring that your invoices contain information that can help to reduce late payments, such as the payment due date and any late penalties. Use an invoice template to ensure you include all the necessary information.