lenders

Skipton Business Finance

Compare Skipton Business Finance and other business lenders with your Capitalise account.

Founded in 2001, Skipton Business Finance are a market leading invoice financing partner wholly owned by the nationally renowned Skipton Building Society.

As an eligible lender under the government backed Enterprise Finance Guarantee Scheme, they're well placed to support small and medium enterprises across multiple facets of UK industry.

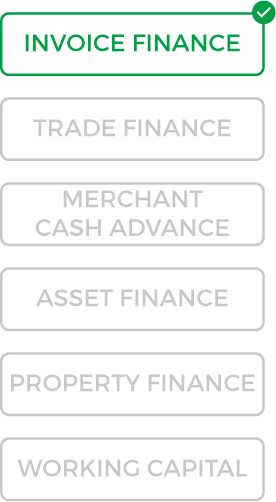

Skipton Business Finance have a proven track record in providing invoice financing solutions to a huge range of industries. From healthcare, property and retail to transportation, manufacturing and distribution, they can help your business to overcome the cash flow gaps caused by lengthy invoice repayment terms. With invoice discounting, you'll be able to advance up to 90% of the funds tied up in unpaid invoices. It's a great option for businesses who already have stringent credit control facilities in place and are happy to continue chasing their customers for payments. Skipton's invoice factoring takes things one step further by providing the same 90% advance as well as taking on the responsibility of securing these payments from your clients. Prefer to keep your invoice factoring confidential? Skipton's flagship product, My White Label, means that all credit control and invoice collections can be done by them but in your company's name, with your logo used on all communications.

Skipton Business Finance is the UK's premier invoice discounting specialist and their experienced lending team can help you to reap the maximum benefits from your credit facility. They underwrite each application based on its individual merits and you'll even be able to advance money from existing outstanding invoices.

Compare Skipton Business Finance with specialist lenders who understand the unique challenges faced by SMEs by completing your Capitalise profile today. It takes just 3 minutes to create your business profile online and we'll then be able to match your company with a selection of finance partners who successfully support UK businesses with invoice factoring and invoice discounting.