Metro Bank

In 2010, Metro Bank became the first newly formed bank to take on the established high street heavyweights in more than a century.

Their unique approach aims to revolutionise customer service within the banking sector and this attitude led them to a trio of trophies at the coveted Moneywise awards in 2016. As the self-branded 'entrepreneurs bank', they pride themselves on helping SMEs and growing businesses to realise their potential by providing a huge range of honest, transparent financing solutions at affordable rates.

Metro Bank products and sectors

Metro Bank may be the most recent addition to the high street, but they bring a wealth of experience when it comes to financially supporting upcoming and established businesses across a diverse spread of sectors.

From business, financial, IT and healthcare services through to construction, manufacturing, wholesale and transportation, they've helped thousands of businesses to overcome the common financial problems that can inhibit growth.

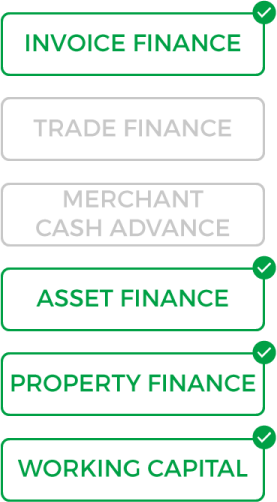

Invoice management can be tricky in the early days of trading, but with invoice financing, this doesn't have to be the case. Receive an advance of up to 85% of your raised invoices with the remaining balance paid to you, minus fees and interest, once the balance has been settled by taking advantage of invoice discounting. This confidential service keeps you in control of all accounts payable communications.

Alternatively, consider invoice factoring if you'd rather outsource your sales ledger, leaving Metro Bank to professionally recover outstanding payments on your behalf by communicating with clients directly.

Working capital finance is a great resource for businesses simply due to their flexibility. Funds can be used for almost any business expense, providing a reliable safety net when you need it most.

The same can be said of their asset finance arrangements. Whether you need to purchase a new van, car, plant, machinery or other asset for your business, they can help you to spread the costs of thee purchases over an affordable term.

Are you a professional landlord looking for a buy to let property loan? Fixed and tracker mortgages are available from Metro Bank over a range of terms to help you secure your next buy to let property.

Metro Bank key benefits

Metro Bank are firmly committed to providing one of the most well-rounded customer service experiences in the lending market. Every applicant is assessed on their own individual merits with underwriters often going out of their way to meet you and understand your goals.

Should you need further help or advice during the application process or once the loan has been setup, you'll be pleased to hear that their high street branches are open until 8pm every weekday evening, as well as being one of the only UK banks to open its doors on a Sunday.

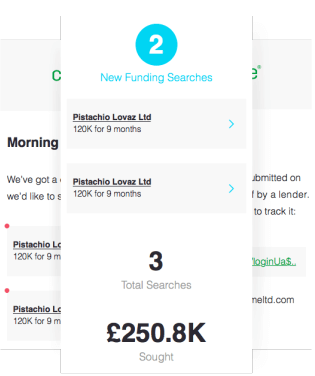

Compare Metro Bank and other lenders instantly

Compare Metro Bank with other lenders today by creating your Capitalise profile in just three short minutes. Our innovative finance matching technology will match your borrowing needs with lenders who have a proven track record supporting businesses within your sector.