lenders

GapCap

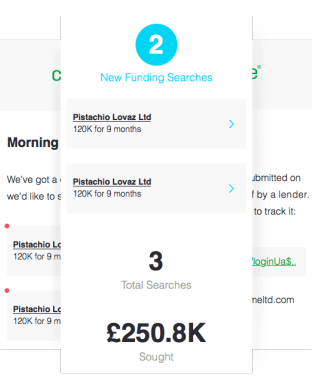

Founded in June 2014, GapCap provides flexible invoice financing solutions to SMEs throughout the country.

They have worked with businesses across a diverse array of sectors, making them an ideal finance partner for any company looking to remove the inconvenience of waiting for outstanding invoices to be paid.