Lenders

Boost Capital

Boost Capital has provided UK businesses with essential funding since its inception in 2002.

Their lending experience stretches across the length and breadth of British industry having funded over 400 different sectors with working capital to help drive growth and bridge unexpected cash flow gaps.

The experts at Boost Capital are the self-styled 'Champions of Small Business', combining competitively priced working capital loans for SMEs with excellent customer service. From the expansion of your business premises and workforce to new stock and equipment upgrades, their flexible borrowing options can be used for any business expense. Boost Capital pride themselves on tailoring specialist solutions for small businesses, creating repayment plans which focus on smaller, more regular payments to avoid significant impacts on cash flow. Their experience has seen them lend to a huge variety of industries such as agriculture, automotive, security, healthcare, financial services, property and recruitment, amongst many others.

Boost Capital aims to approve applications within 24 hours and release funds within a matter of days. They have invested heavily in streamlining the entire application from start to finish and, with minimal paperwork needed, almost everything can be completed online. Their fantastic reputation within the market sees 85% of customers returning to borrow at a later date. The unsecured nature of these working capital loans are particularly appealing to small businesses who won’t be required to use personal or business assets as security.

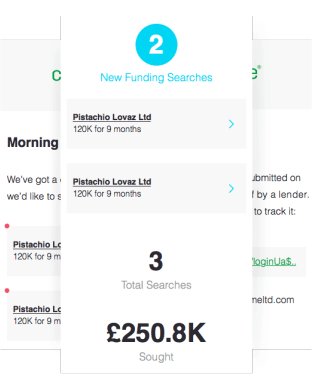

Compare Boost Capital with a huge range of working capital lenders today by creating your Capitalise profile in just 3 minutes. Our online platform can help to match your business with suitable finance partners who can provide you with the capital needed to plug gaps in cash flow as well as sharing their experiences of funding businesses just like yours. Register today and discover a world of lenders ready and waiting to help your business grow.