How important is coaching?

The accountancy profession is continuing to move more team members along the journey from a recorder of historical transactions to being insightful advisers. This means that we know the leadership teams of our accountancy partners spend a considerable amount of energy in coaching their team.

The Ignition white paper “Accountants guide to increasing revenue through advisory services” lists training your team as the second step in the process.

“A key part of offering advisory services is ensuring that you have a team that can do the work. If it is all depending on just one or two people to deliver the work from start to finish, you will run out of capacity very quickly. This needs to be a team effort to come together well.”

Aynsley Damery of Clarity also talks about how “advisory services” need to be repeatable advisory, so that it doesn’t rely on the senior leadership time only.

It’s generally accepted that the professional examinations only take trainees so far in their understanding of how to work with clients on more commercial matters. ‘On the job’ training and mentoring is also required to fill in those gaps.

So however you develop your team, what’s key is that it has to be effective and efficient.

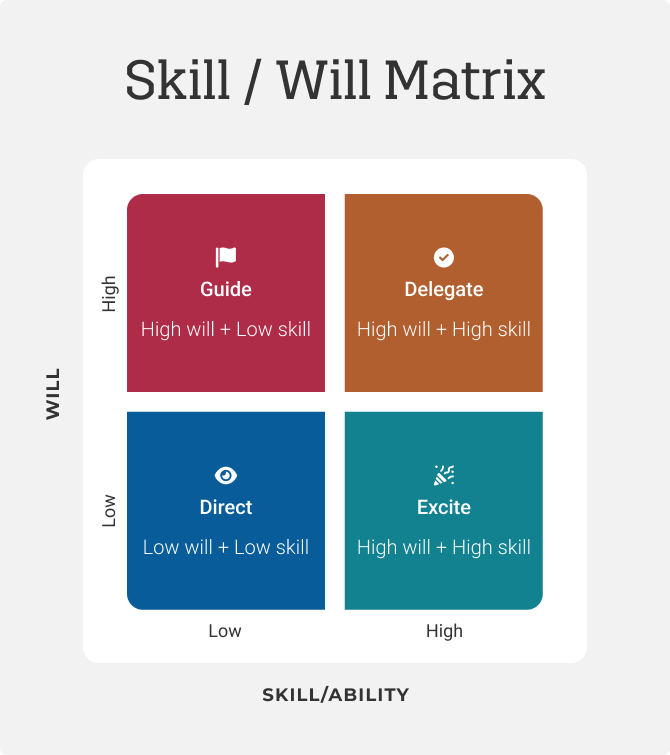

The Skill/Will Matrix was devised by Max Landsberg in his book “The Tao of Coaching”. It recognises that not all employees are the same. It provides a useful assessment tool to help you understand how to coach appropriately and get the most out of each of your team members.

Identifying the level of Skills and the amount of Will

The matrix recognises that team members may be unwilling or unable to complete the tasks they are set. Or we may have unassumed they are, but actually they are more than capable and our intensive management style may have demotivated them.

By coaching them appropriately, their will should increase and with more experience and confidence, their skill levels will also improve.

How Landsberg suggests you can use the Skill/Will Matrix

1. If Skill & Will are both low, you need to be more direct and supervise closely. First a leader needs to build the will with clear briefs, identifying their personal motivations and by showing them what they can achieve if they progress. Then you can build the skill. Capitalise has many training sessions, online learning modules and support from Partnership Managers to assist with direct training.

2. Where Skill is low but there is high Will, you can guide by being available to answer questions and create a risk-free environment to make mistakes. Once the employee succeeds, you can relax control.

3. Where there is a high level of Skill but low Will, you will need to Excite and Motivate. You can only do this when you identify the reason for the low will, eg lack of confidence, previous experience of failing, role not exciting them anymore etc. Once you are able to remove those obstacles, you can motivate them to increase their will. Monitor their results and feedback often to keep increasing their will.

4. If Skill and Will are both high, you need to stand back and delegate the tasks to them. Explain the objective but allow them to work out how to deliver, and provide regular praise. To improve their skills even further, give them more responsibility and more challenging tasks.

Creating a team who can leverage your advisory work

Accountants who can offer advisory work as a value-added service to their clients find they have significant influence over the future success of those clients and the bond deepens.

Team members are excited by the prospect of having such an impact and they will remain more loyal to a firm which can provide them with those opportunities for increasing their skills and job satisfaction.

If you would like to access training support for your firm, so that you can offer more services to your clients, speak to your Partnership Manager or book a call with the Capitalise team.