Credit review service - customer success story

How this business increased their trade credit limit by 5x

Credit limit £5,000, to £28,000

Business credit score 41 - 82

An adult care provider business was applying for a tender which would have helped to expand their business. However their business credit score was not showing a true reflection of how they were really doing. Due to their business credit score and trade credit limit, their bid was being harmed.

The business had also been generating revenue from renting several premises and had aspirations to expand by purchasing more properties. However their low business credit score was also hampering their ability to access finance to increase their property portfolio.

To overcome these challenges, the business applied for a credit review via the Credit Review Service.

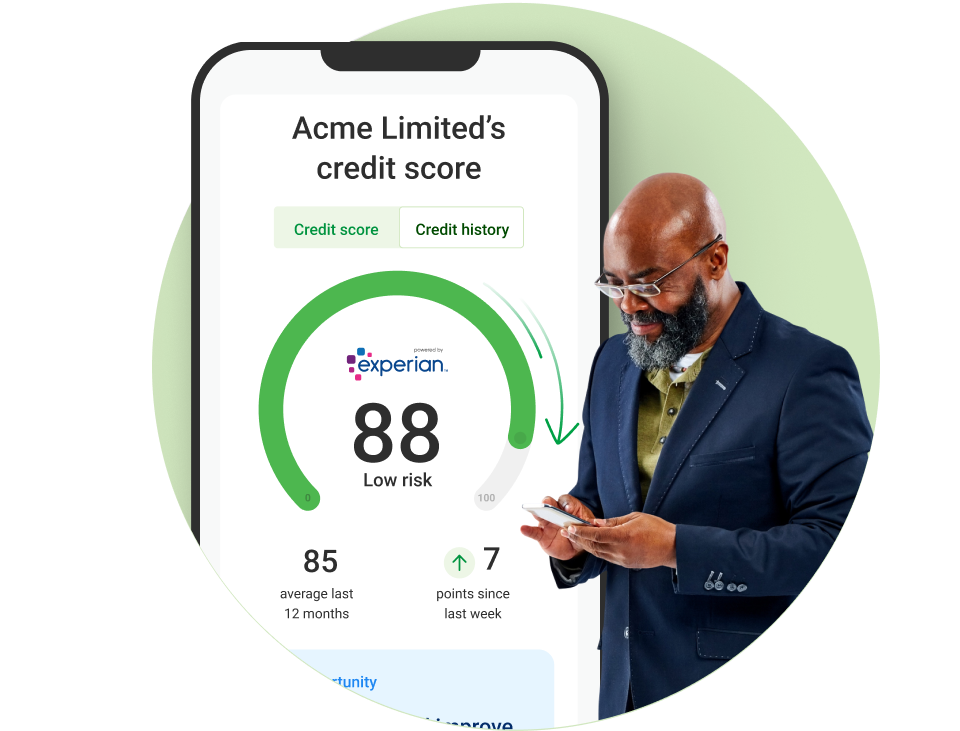

Using the Credit Review Service, the business was able to provide more up to date information to the credit bureau Experian. This allowed them to update their business credit score so it was a reflection of the businesses’ financial health that reflects how they’re really doing today.

Their business credit score soared from 41, to one of the highest brackets at 82.

They were also able to increase their trade credit limit more than 5 x, rising from £5,000 to an impressive £28,000.

With a strong business credit score and trade credit limit, the business was able to submit a strong tender for new work. This enabled them to win larger contracts, in turn growing their business.

With their improved business credit score, they are now also well positioned to access affordable business finance, allowing them to purchase property that will drive their expansion, when the opportunity arises.

See if you could increase your trade credit limit with an improved business credit score.

Apply for a credit review.