What Financing Options Are Available?

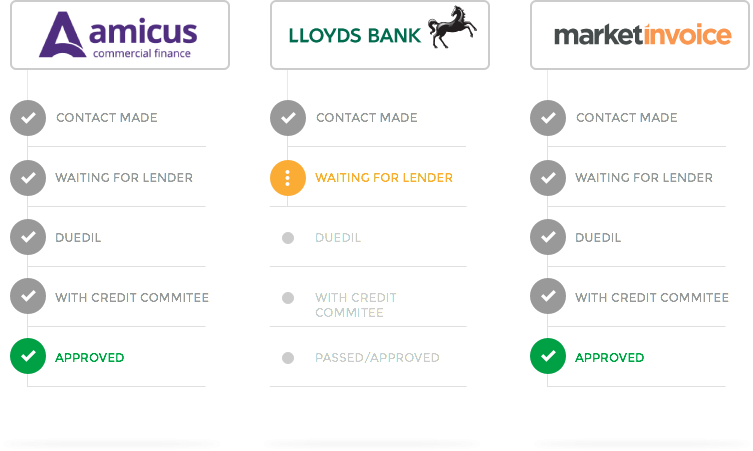

No two Manchester business loan applications will ever be the same which is why we are constantly working to bring the very latest innovations in commercial finance to borrowers.

-

Asset Finance | Spending out large sums of money on brand new equipment can be particularly problematic for SMEs and growing businesses. Avoid these upfront costs by considering asset finance as a potential solution. With hire purchase, lease hire, contract hire and refinancing options all available, you can get full, unrestricted access to the assets you need without putting cash flow at risk.

-

Invoice Finance | Having to wait weeks or months for your customers to settle their invoices can hold your business back from taking advantage of growth opportunities. With invoice factoring and invoice discounting, you'll be able to advance a percentage of your raised invoices almost immediately with the added option of outsourcing your sales ledger management should you need it.

-

Merchant Cash Advance | Use your credit and debit card takings to your advantage by accessing a merchant cash advance. Receive a lump sum from outset and pay the balance back each time one of your customers pays by card through your EPOS terminal or card reader.

-

Trade Finance | Increasing your customer orders in both number and size will be paramount to your business growth, but having to pay suppliers for additional goods can put a strain on your cash flow. With trade finance, your lender will fund the purchase of goods from your supplier on your behalf with the balance repaid once your customer settles their invoice.

-

Working Capital Finance | No matter whether you're looking to grow your workforce, take care of the latest batch of bills or purchase new assets, working capital finance may well be able to help. This fast, flexible loan type of lent as a lump sum and repaid in affordable instalments that fit in with your past and projected revenues.

-

Property Finance | It's rare for any commercial property purchase, construction or development project to go ahead these days without some form of financing. Our huge range of specialist property finance lenders can help you and your business to secure bridging loans, development loans and commercial mortgages to give your project the best possible chance of success.